- Solutions

- Airlines & Aviation Fuel Procurement

Airlines & Aviation Fuel Procurement

Airlines & Aviation Fuel Procurement

Numin delivers daily-updated probabilistic price forecasts specifically tailored for jet fuel, aviation gasoline, and the underlying crude and refining crack spreads that drive aviation fuel costs worldwide.

Our models cover all major benchmarks: NYMEX ULSD (Heating Oil) as the primary jet fuel proxy, Gulf Coast Jet Fuel, Singapore Jet Kero, ICE Gasoil, Brent and WTI cracks, and regional into-plane differentials.

Designed explicitly for airlines, cargo carriers, fractional operators, and aviation leasing companies that consume large volumes of aviation fuel and seek to optimize procurement, hedging, and cost forecasting. Core Deliverables

Daily Forecast

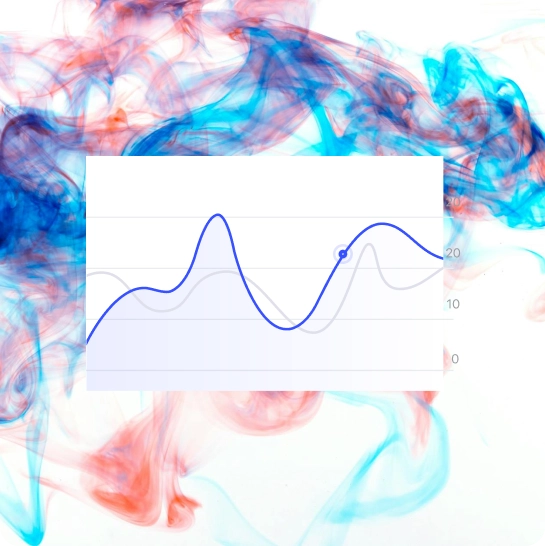

Daily forward price-path distributions with P10/P50/P90 confidence bands are provided for jet fuel, ULSD, Gasoil, and refining cracks, alongside dynamically updated hedge-ratio recommendations that optimize instruments such as ULSD futures, Brent calls, and crack-spread options.

Weekly Forecast

Weekly forward price-path distributions and crack-spread outlooks capture near-term seasonal patterns and emerging geopolitical risks affecting jet fuel, ULSD, Gasoil, and refinery margins.

Monthly

Monthly forward price-path distributions deliver long-range confidence bands for jet fuel, ULSD, Gasoil, and refining cracks, supported by regional jet fuel basis forecasts for Singapore, the Gulf Coast, and Northwest Europe, as well as fuel-surcharge and ticket-pricing scenario analysis tied directly to forward cost curves.

Practical Application

Forward-Looking Fuel Cost Intelligence

Plan, hedge, and communicate fuel exposure using living price decks, optimal coverage windows, and scenario-driven cost forecasts.

Replace quarterly banker or broker curves with living, daily-refreshed probabilistic decks for annual budgeting and route profitability modeling

Identify statistically optimal forward-covering windows (the exact months when locking in jet fuel is most advantageous over the next 12–36 months)

Stress-test fuel expense lines under thousands of realistic price-path scenarios instead of three static cases Optimize hedge timing and instrument selection to minimize basis risk between financial contracts and physical into-plane costs

Provide forward-looking fuel cost guidance for investor presentations, earnings calls, and debt-covenant forecasting

Delivery Options

Fuel Forecast Delivery for Airlines

Enterprise-grade delivery options designed to integrate directly into airline fuel procurement, hedging, and financial planning workflows.

- Private REST/WebSocket API tailored to your selected fuel benchmarks and regions

- Daily pre-market PDF highlighting the highest-conviction hedging and procurement windows

- Weekly and monthly strategic reports with refining-margin scenarios and inter-commodity correlation updates

- Python and JavaScript client libraries for direct integration into revenue management, treasury, and risk systems